STUDENT LOANS AND DEBT, Investing, Personal Finance, Life Skills, Careers

- Zip

What educators are saying

Description

Student Loans and Debt

Investing Wisely in Your Education

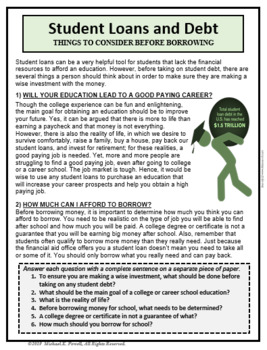

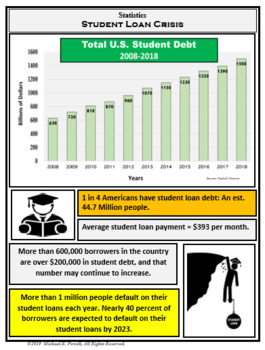

Student debt has become a serious problem in American. The average student that graduates from college has over $37,500 in student debt. After graduating college, many people struggle to find good paying careers and make their student loan payments. Therefore, it has become very important for students to learn about the student debt crisis and learn to make wise choices about borrowing money for school and selecting the right educational path. This self-guided lesson covers the following objectives:

OBJECTIVES: Students will be able to:

· Define financial aid, student loans, grants, default, garnish, delinquent, and scholarships.

· Identify the trend occurring with student debt in the U.S.

· Describe why it is important to evaluate risks and rewards when borrowing money for school.

· Identify things you should consider before borrowing money for school.

· Explain the requirements of paying back student loans.

Please take a look at these other lessons that are related to personal finance.

Credit Cards; Disadvantages and Advantages

Comparison Shopping, Being a Wise Consumer

Consumer Awareness, COMMON SCAMS STUDENTS SHOULD BE AWARE OF

Feedback is Greatly Appreciated.

Thank You

Michael K. Powell