Grade 7 &8 Financial Literacy (8 Lessons, Practice Slides, Unit Test, plus more)

What educators are saying

Also included in

- This bundle includes 14 units. Included in this bundle:Grade 7/8 Number Sense and NumerationGrade 7/8 IntegersGrade 7/8 PatterningGrade 7/8 ProbabilityGrade 7/8 Financial Literacy (Unit Rates, Interest and Exchange Rates)Grade 7/8 Coordinate Grids and TransformationsGrade 7/8 FractionsGrade 7/8 MeasPrice $158.40Original Price $176.00Save $17.60

Description

This unit is aligned with the expectations of the NEW Ontario Mathematics Curriculum. This unit was designed during COVID-19, to assist in curriculum delivery in the virtual environment.

The specific expectations that this packet addresses are listed by grade:

Grade 7

Money Awareness:

F1.1 identify and compare exchange rates, and convert foreign currencies to Canadian dollars and vice versa

Financial Management

F1.2 identify and describe various reliable sources of information that can help with planning for and reaching a financial goal

F1.3 create, track, and adjust sample budgets designed to meet longer-term financial goals for various scenarios

F1.4 identify various societal and personal factors that may influence financial decision making, and describe the effects that each might have

Consumer and Civic Awareness:

F1.5 explain how interest rates can impact savings, investments, and the cost of borrowing to pay for goods and services over time

F1.6 compare interest rates and fees for different accounts and loans offered by various financial institutions, and determine the best option for different scenarios

Grade 8

Money Concepts:

F1.1 describe some advantages and disadvantages of various methods of payment that can be used when dealing with multiple currencies and exchange rates

Financial Management

F1.2 create a financial plan to reach a long-term financial goal, accounting for income, expenses, and tax implications

F1.3 identify different ways to maintain a balanced budget, and use appropriate tools to track all income and spending, for several different scenarios

F1.4 determine the growth of simple and compound interest at various rates using digital tools, and explain the impact interest has on long-term financial planning

Consumer and Civic Awareness:

F1.5 compare various ways for consumers to get more value for their money when spending, including taking advantage of sales and customer loyalty and incentive programs, and determine the best choice for different scenarios

F1.6 compare interest rates, annual fees, and rewards and other incentives offered by various credit card companies and consumer contracts to determine the best value and the best choice for different scenarios

Ways to Use this Resource:

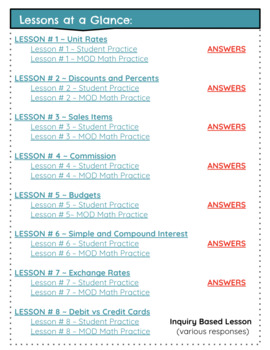

There are eight lessons in this unit. Each lesson has a teacher’s instructional slide deck and a set of rule book notes that can be copied by your students. Once the lesson has been completed, you have two different sets of practice questions. One for your whole class, and the other has modifications made. These lessons have MOD Math in the title. These modifications include step-by-step instructions and hints which will make it easier for IEP students. Each lesson has similar questions, therefore taking up the practice work will be easier. Once the practice questions have been completed, use the ANSWERS slide deck to take it up.

Brief Lesson Overview:

Lesson # 1 ~ Unit Rates

Lesson # 2 ~ Discounts and Percents

Lesson # 3 ~ Sale Items

Lesson # 4 ~ Commissions

Lesson # 5 ~ Budgets

Lesson # 6 ~ Simple and Compound Interest

Lesson # 7 ~ Exchange Rates

Lesson # 8 ~ Debit vs. Credit Cards

At the end of the unit, use the Practice Test to review key concepts. Then test your students with the Final Unit Test.

Bonus "Do I have enough?" activity.