Financial Planner for Students Teachers, Budget, Save, Invest Money, Credit Wise

- PDF

Description

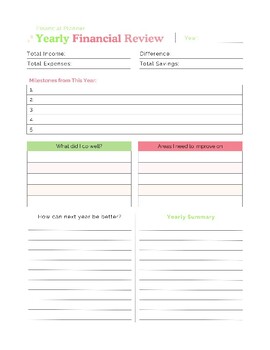

Introducing your cutting-edge Financial Planner, your trusted companion for helping students learn and understand finances, budgeting, and the importance of saving. Or, use it yourself on your path to financial success. Designed with precision and tailored to your unique needs, this intelligent tool combines expert monthly organization with intuitive long-term planning to empower you in achieving your financial goals.

With your Financial Planner, you can effortlessly organize and manage your finances, from budgeting and expense tracking to long-term investment and savings. Use and reuse your planner from month to month and year to year, while also keeping track of long-term goals for both your students and you.

Key Features:

1. **Comprehensive Financial Snapshot:** Help your students understand the importance of getting a clear overview of your financial health, including income, expenses, assets, and liabilities, all in one place.

2. **Goal-based Planning:** Set and track specific financial objectives, whether it's saving for a dream vacation, purchasing a home, or planning for retirement.

3. **Intelligent Budgeting:** Create realistic budgets based on income and spending habits that help you stay on track.

4. **Investment Optimization:** Keep your investment info. all in one place to maximize your strategies and recommendations.

5. **Retirement Planning:** Calculate your retirement needs and achieve your retirement goals.

6. **Scenario Analysis:** Simulate different financial scenarios to brainstorm more ways to save and alternate streams of income potential.

7. **User-friendly Interface:** Intuitive and easy-to-navigate, ensuring a seamless experience for users of all levels of financial expertise. Print your planner and use a hard copy or upload it into your favorite notes app, such as Good Notes or Notability to use your planner digitally.

Help your students take charge of their financial futures and experience the confidence and peace of mind that comes with getting organized for your financial future, as well.