Essential Personal Financial Literacy Skills for High School Students BUNDLE!

What educators are saying

Products in this Bundle (19)

showing 1-5 of 19 products

Bonus

Description

Topics include income taxes, understanding pay stubs and paychecks, money management, finding apartments, health insurance, banking, budgeting, and more! This bundle of complete, stand-alone personal finance lessons and activities can be used throughout the year to ensure students leave high school with the essential financial skills they'll need after high school.

The lessons and activities can be used together in a consumer math/personal finance class, or they can be worked into your curriculum throughout the school year so that students leave high school with the financial skills they'll need as they venture out on their own. These lessons and activities can be used in any order.

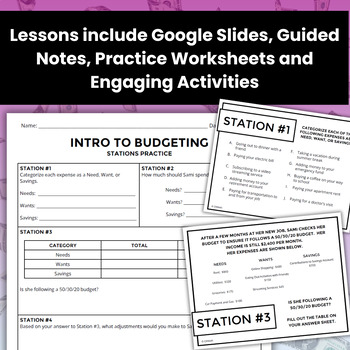

Some lessons are complete with Google Slides and Guided Notes for easy instruction, while others are independent, exploratory activities where students will research the actual costs and options of buying groceries, finding an apartment, etc. Also includes a fun activity where students will design a dream vacation on a budget - great for before spring or summer break.

Several activities in this bundle are included in both paper (PDF) and digital Google formats.

These lessons can be done in any order, but a suggested pacing guide is included if you need a place to start!

The following lessons are complete with Google Slides and/or Guided Notes for easy instruction:

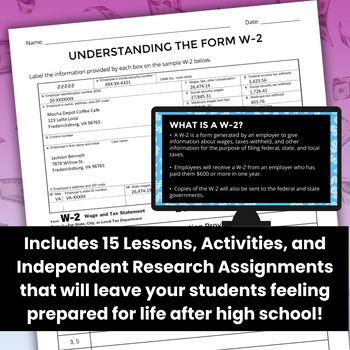

- Filing Federal Income Taxes Personal Finance Unit

- Students learn to understand the information provided on a W-2, choose a deduction, read tax tables, and complete a basic 1040!

- Includes four lessons with Google Slides, Guided Notes and Practice

- Includes a follow-up practice Scavenger Hunt in a PDF paper format

- Understanding Your Pay Stub

- Students learn to interpret the information provided on a pay stub.

- Includes Guided Notes and a Practice Worksheet using realistic pay stubs

- Also includes a follow-up practice Scavenger Hunt in both PDF paper and Google Forms digital formats.

- Intro to Budgeting Lesson

- Students learn how to set up a basic budget following a 50/30/20 budgeting strategy

- Includes Google Slides and Guided Notes

- Also includes a follow-up stations practice activity

- Understanding Health Insurance

- Students learn the basics of health insurance plans. They'll learn basic vocabulary and how to compare plans.

- Includes Google Slides and Guided Notes as well as an additional practice worksheet for students

- Managing Your Money - Using a Spending Log, Paying Bills, and Writing Checks!

- Students learn how to track their spending, pay bills, and write checks.

- Includes Google Slides, Guided Examples Worksheet, and Spending Log Activity that requires students to record 15 transactions on a spending log, as well as write checks and complete bill pay stubs.

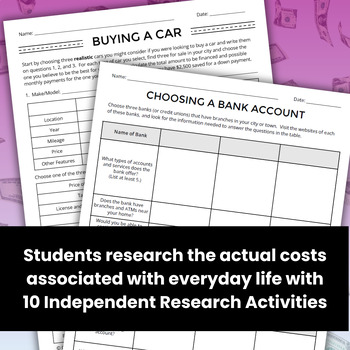

The following are independent, exploratory activities where students will research options and costs online.

- Grocery Shopping on a Budget - Both PDF paper and digital version on Google Sheets are included.

- Searching for a Job - PDF version only

- Finding an Apartment - Both PDF paper and digital version on Google Sheets are included.

- Buying a Car - PDF version only

- Choosing an Auto Insurance Company - PDF version only

- Credit Card Comparison - Both PDF paper and digital version on Google Sheets are included.

- Making the Minimum Payment Credit Card Activity - Students will need access to Google Sheets for this activity.

- Choosing a Bank Account - PDF version only

- Dream Vacation on a Budget - This is not an essential skill - but a fun activity that works well before spring or summer break. PDF version only.

Just interested in the exploratory activities? A smaller bundle of 11 exploratory activities can be found here.

**You'll need a Google Account to access the files and Google Slides. The Google Slides in this resource are NOT editable.**

The information provided in these resources does not, and is not intended to, constitute tax or financial advice; instead, all information, content, and materials available are for general informational purposes only. Information in these resources may not constitute the most up-to-date tax or other information. These resources may contain information regarding third parties. Such information is only for the convenience of the reader. CKMath does not recommend or endorse any third party, and CKMath is not affiliated with, nor sponsored by, the United States Internal Revenue Services.