College, Career, Financial Literacy, and Life Skills Unit and Project (~1 month)

- Zip

Products in this Bundle (2)

Description

I have this product available in multiple formats: Google, Microsoft, PDF, etc.

Please email me at sjewitt@enoriveracademy.org if you prefer another format and I can provide that!

Whole Unit and Project includes:

-3 days of written lesson plans

-1 Presentation with 53 slides to use with each of the 3 days of instruction

-1 Assessment / Quiz to use after instruction

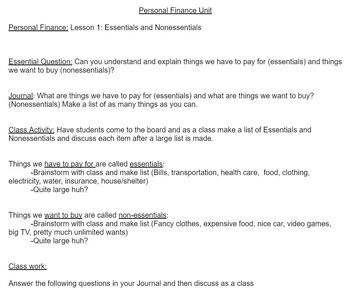

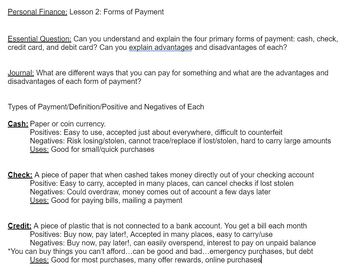

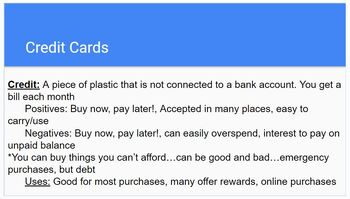

-Essential questions, journal/warm up activities, notes, definitions, and discussion questions for each lesson.

Lesson 1: Essentials and non-essentials

Lesson 2: Forms of payment: Cash, check, credit cards, debit cards

Lesson 3: Saving, spending, and donating

Day 4: Quiz

Project:

-Students will create a personal financial budget for an anticipated career, salary, and expenses for when they graduate college. There are many steps to this project that are clearly laid out and and broken into chunks.

This could also be modified to be used as a unit lesson plan for college exploration, career education, life skills, financial planning, or personal finance.

Students will:

-Select a career they think they may be interested in

-Research the demands of the job--skills necessary, hours worked, and necessary education.

-Research colleges that may offer the education necessary for their chosen career.

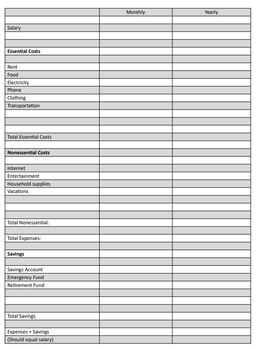

-Determine what essential costs they will have to pay for (rent, food, electricity, clothing, transportation, etc.)

-Determine what non-essential costs they may want to save for (vacations, retirement, emergency fund, etc.)

-Choose an actual apartment or house to rent in a city of their choosing

-Decide what to do with money that is not spent / "left over" each month

-Discuss the importance of having a balanced budget, how one can help you save and spend, and plan for the future.

-Create a pie graph/chart that shows a visual distribution of your money

-Fill out a monthly / yearly budget chart with income and expenses

-**Includes extensions that challenge students to research and include information on income tax, state and federal salary deductions, gross vs. net salary, health and car insurance, cost of college, and paying / repaying for college.

The project can easily be modified to be easier or more in-depth.

It also includes:

-A pacing guide (~15 class days / 3 weeks)

-Grading rubric

Lessons may be purchased separetly here:

https://www.teacherspayteachers.com/Product/Personal-Finance-Unit-Lesson-plans-presentation-and-2-page-Quiz-4-days-5647204

Project may be purchased separetly here:

https://www.teacherspayteachers.com/Product/Personal-Finance-Budget-Project-3-weeks-4184650

Check out my other great Social Studies resources at my store:

https://www.teacherspayteachers.com/Store/Scotty-Js-Social-Studies