TAXES Unit Lessons 2-5: IRS Withholding Calculator

- Zip

Description

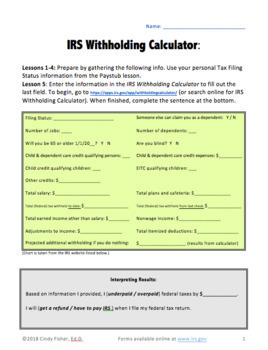

The Taxes Unit introduces vocabulary related to completing a tax return. At the end of the unit, students complete a simulation on the IRS website to calculate whether they are withholding enough money from their assigned paycheck.

For this unit, it's most helpful if students have a computer or mobile device with internet access. At the minimum, the teacher could demonstrate it as a class exercise. Without internet access, you could complete Lessons 2, 3 and 4.

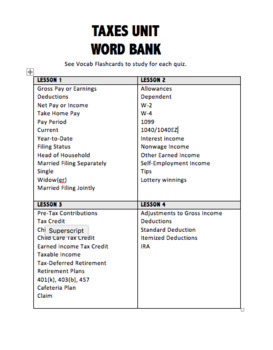

Using the Paystub and Filing Status scenario from Lesson 1 (a separate download because of file size), students learn and apply tax vocabulary related to income, pre-tax contributions, deductions, and tax credits.

In Lessons 2, 3, and 4, they complete a planning chart. There is minimal calculation required in these lessons if the paystub is completed.

Skills and concepts:

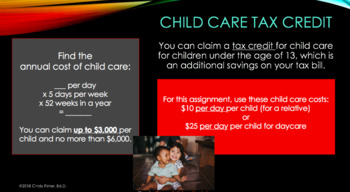

- Calculate Child Care expenses with given information.

- Compare their salary with the given salary given to figure out whether they qualify for the EITC.

- Round decimal amounts to the nearest dollar when entering on the IRS Withholding Calculator.

- Complete selected portions of a W-2 and a W-4 form.

- Apply 28 vocabulary words related to income, deductions, and tax credits.

Lesson Plans include Possible Points of Confusion to help you to know what to emphasize.

Flash cards are provided for individual study before each quiz. If students do not have computer access to view electronically, they can be printed as a handout by opening in Google Slides and printing multiple slides to a page.

Quizzes provided can be used as a pre-test for each lesson, providing an anticipatory set. The post-test can be given after each lesson or at the end of the unit. There are 36 short-answer questions on quizzes 2, 3, and 4. Lesson 1, a separate download, has 12 additional quiz items.

Simulation: In Lesson 5, students go online to the actual IRS website to apply learning by entering data from their assigned scenario. Since the calculator has been revised for 2020, it may look different. You can go to the IRS website directly rather than using links in the lesson. They draw a conclusion about their scenario, and as an option, they write a paragraph about the exercise.