Career, Budgeting, & Life Simulation Camp/4 day, 12 hour lesson

Stephanie LaBarge

1 Follower

Grade Levels

4th - 8th, Homeschool, Staff

Resource Type

Formats Included

- Google Docs™

Pages

39 pages

Stephanie LaBarge

1 Follower

Made for Google Drive™

This resource can be used by students on Google Drive or Google Classroom. To access this resource, you’ll need to allow TPT to add it to your Google Drive. See our FAQ and Privacy Policy for more information.

Description

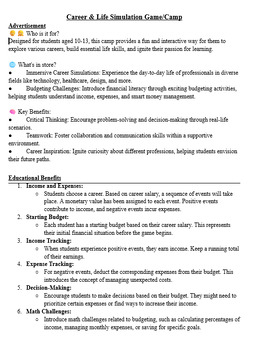

Advertisement

Who is it for?

Designed for students aged 10-13, this camp provides a fun and interactive way for them to explore various careers, build essential life skills, and ignite their passion for learning.

What's in store?

- Immersive Career Simulations: Experience the day-to-day life of professionals in diverse fields like technology, healthcare, design, and more.

- Budgeting Challenges: Introduce financial literacy through exciting budgeting activities, helping students understand income, expenses, and smart money management.

Key Benefits:

- Critical Thinking: Encourage problem-solving and decision-making through real-life scenarios.

- Teamwork: Foster collaboration and communication skills within a supportive environment.

- Career Inspiration: Ignite curiosity about different professions, helping students envision their future paths.

Educational Benefits

- Income and Expenses: Students choose a career. Based on career salary, a sequence of events will take place. A monetary value has been assigned to each event. Positive events contribute to income, and negative events incur expenses.

- Starting Budget: Each student has a starting budget based on their career salary. This represents their initial financial situation before the game begins.

- Income Tracking: When students experience positive events, they earn income. Keep a running total of their earnings.

- Expense Tracking: For negative events, deduct the corresponding expenses from their budget. This introduces the concept of managing unexpected costs.

- Decision-Making: Encourage students to make decisions based on their budget. They might need to prioritize certain expenses or find ways to increase their income.

- Math Challenges: Introduce math challenges related to budgeting, such as calculating percentages of income, managing monthly expenses, or saving for specific goals.

Total Pages

39 pages

Answer Key

N/A

Teaching Duration

4 days

Report this resource to TPT

Reported resources will be reviewed by our team. Report this resource to let us know if this resource violates TPT’s content guidelines.